The second step involves contacting a factoring company. These people will repay their debts within the next month or two. The process starts by offering goods or services to creditworthy customers. You don’t need an accounting degree to figure out invoice factoring. If you’re having trouble remembering the difference between the two, know that recourse factoring helps the lender and non-recourse favors the borrower. The arrangement protects the seller from bankruptcy and insolvency. Only the most reliable factoring companies can provide non-recourse factoring. The example mentioned below about the fintech startup involves recourse factoring because the factor took a “recourse” to recover the remaining invoice funds. It depends entirely on whether you secure recourse or non-recourse factoring. You may or may not have to repay outstanding debts to your factor.

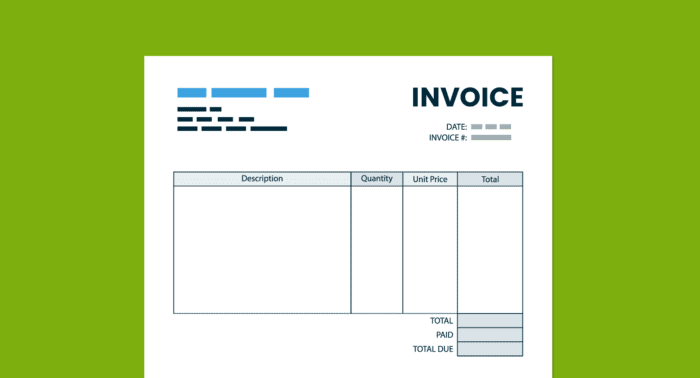

There are also two varieties of invoice factoring – recourse and non-recourse. Many factors will provide the seller with a cash advance on the same day. Whatever you call it, the transaction serves the same purpose – using existing debts to fix cash flow problems. Invoice factoring goes by other names, including accounts receivables factoring and accounts receivables financing. The factor provides the company with the funding it needs to meet current cash demands. The business sells its accounts receivables (invoices) to an outside party (a factor) at a slightly discounted price.

invoice financingīuilding off the point above, invoice factoring is a financial transaction when a company turns its debts into cash.

INVOICE FACTORING TEMPLATE HOW TO

Best Car Insurance For College Students.Should You Get Home Contents Insurance?.How Much Should You Contribute To Your 401(k)?.How Much Do You Need To Have Saved For Retirement?.The Beginner’s Guide To Saving For Retirement.Investment Calculator: How Much Will You Earn?.How To File A FAFSA As An Independent Student.Best Companies For Student Loan Refinancing in 2022.Best Personal Loans For Excellent Credit.Understanding Overdraft Protection and Fees.

0 kommentar(er)

0 kommentar(er)